Mortgage Rates Today: Decoding the Numbers for Your Future

Alright, buckle up, folks, because the housing market is about to get a shot of adrenaline. We’re seeing mortgage rates dip, sure, and that’s always welcome news. But the real story here isn’t just a few basis points shaved off your monthly payment. It’s about something much, much bigger: a fundamental shift in how we think about homeownership and financial stability.

The headlines are all focused on the day-to-day fluctuations. "Mortgage Rates Drop Before Thanksgiving!" one headline shouts. Another whispers, "Rates Tick Slightly Down Again." But I'm not interested in the tiny ripples; I’m watching the tidal wave building beneath the surface.

The Big Picture: Stability in a Volatile World

What everyone seems to be missing is this: even with the small dips and rises, rates are still significantly lower than they were just a few months ago. We’re talking about real savings, real opportunities for people who felt locked out of the market. And that's where the potential for rate float-down options come in, too. It's like a safety net, allowing you to lock in a rate and then grab a lower one if things continue to improve.

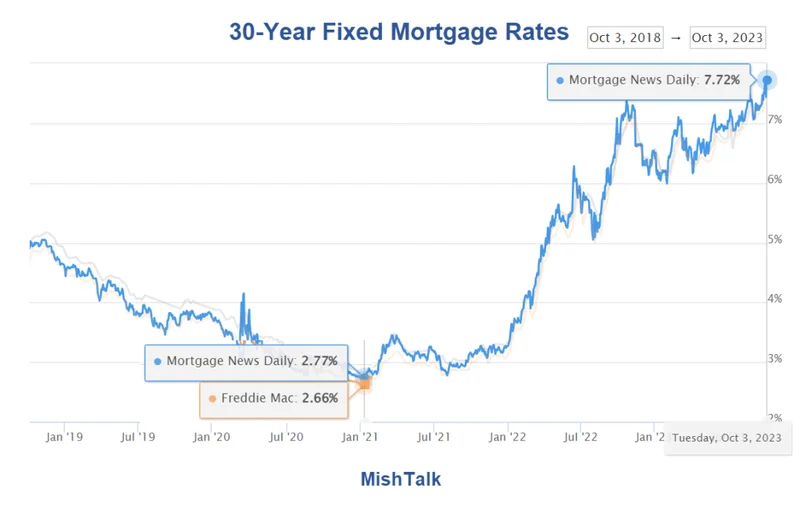

Think about it like this: for the past few years, buying a home has felt like navigating a minefield. Sky-high prices, bidding wars, and interest rates that seemed to climb higher every single day. It was enough to make anyone throw their hands up in despair. But now, the landscape is starting to change. The ground is stabilizing.

And it's not just about lower rates, either. The rise in pending home sales that Freddie Mac's Chief Economist, Sam Khater, mentioned? That's a sign of resilience. People are still dreaming of owning their own piece of the world, and they're finding ways to make it happen. Mortgage and refinance interest rates today, November 26, 2025: 30-year rates dip as pending home sales rise

So, what does it all mean? It means the dream of homeownership isn't dead. It's just evolving.

I remember back in the early days of the internet. People were terrified. They thought it would destroy communities, isolate us, and turn us all into screen-addicted zombies. And, yeah, there have been challenges. But look at what the internet actually did: it connected us, empowered us, and opened up a world of possibilities that we never could have imagined.

This dip in mortgage rates, coupled with the other positive indicators, feels like a similar turning point. It's a chance to reimagine the way we approach homeownership, to make it more accessible, more sustainable, and more aligned with our individual needs and goals.

We're seeing average rates for 30-year terms hovering around 6%, according to Zillow, and 15-year options dipping even lower. That's a far cry from the 7% we saw earlier this year, and it opens up a whole new range of possibilities. Suddenly, those monthly payments don't seem quite so daunting. That dream home feels a little bit closer.

But let's not get carried away. As Sam Williamson, senior economist at First American, wisely pointed out, there's still uncertainty ahead. The Federal Open Market Committee's December meeting could throw a wrench in the works, and we need to be prepared for short-term volatility.

Still, I can't help but feel a sense of optimism. When I see these trends, I don't see just numbers. I see families finally able to put down roots. I see young couples building their future. I see retirees finding a place to enjoy their golden years.

And the best part? We're just getting started.

What if we could use technology to streamline the mortgage process, making it faster, easier, and more transparent? What if we could create new financial products that are tailored to the unique needs of today's homebuyers? What if we could build sustainable communities that are both affordable and environmentally friendly?

These aren't just pipe dreams. They're real possibilities, and they're within our reach.

Of course, with great power comes great responsibility. We need to be mindful of the ethical implications of these changes. We need to ensure that everyone has access to the resources and support they need to make informed decisions. We need to protect vulnerable communities from predatory lending practices.

But if we can do that, if we can harness the power of technology and innovation while staying true to our values, then I believe we can create a future where homeownership is a source of stability, opportunity, and pride for everyone.

I saw a comment on a Reddit thread the other day that really stuck with me. Someone wrote, "It feels like we're finally turning a corner. Maybe, just maybe, the American Dream isn't dead after all." And you know what? I think they might be right.

A New Foundation is Being Poured

The housing market is more than just numbers and statistics. It's about people. It's about dreams. It's about building a better future, brick by brick, and loan by loan. And with these latest trends, it feels like we're finally laying the foundation for something truly special. So let’s build it together.