Mortgage Rates Today: What the Numbers Say on 30-Year Fixed & Refinance

Generated Title: Mortgage Rate Rollercoaster: Is This the Bottom Before the Climb?

The Dip, the Data, and the Doubt

Mortgage rates are behaving like a toddler on a sugar rush: bouncing between highs and lows with no discernible pattern. We're seeing headlines touting the "lowest rates of the year," specifically, the 30-year fixed-rate mortgage hitting 6.06%, according to Zillow data from late November 2025. Great news, right? Maybe. But let's dissect this before popping the champagne.

First, the good news: a 6.06% rate is a noticeable improvement from the 7%-plus rates we saw earlier in the year. For a $400,000 mortgage, that difference translates to hundreds of dollars saved per month and tens of thousands over the life of the loan. The articles are correct that, relatively speaking, this is good news.

But here's where the data gets murky. Other sources are showing different numbers. Fortune, citing Optimal Blue data, puts the 30-year fixed at 6.189% as of November 24th. That's a discrepancy of roughly 13 basis points. Thirteen basis points might sound trivial, but on a large mortgage, it adds up. Which number is "real"? It depends on who you ask, and more importantly, when you ask. What are today's mortgage interest rates: November 24, 2025?

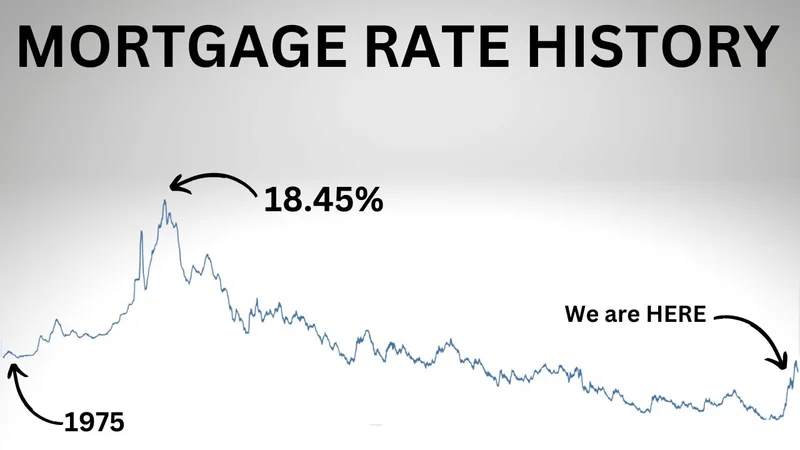

The volatility we're seeing is not just in the numbers themselves, but in the reporting of those numbers. Articles published on consecutive days show rates moving up and down by fractions of a percent. This intraday volatility makes it hard to know the true current rate.

And this is the part of the report that I find genuinely puzzling. The experts quoted are all over the map. Some predict further rate cuts from the Federal Reserve, citing recent unemployment data. Others caution against expecting drastic changes, pointing to overall economic uncertainty. Sam Williamson, senior economist at First American, notes that "uncertainty ahead of the Federal Open Market Committee’s December meeting... could result in short-term volatility in mortgage rates." Translation: nobody really knows what's going to happen.

The Refinance Mirage

The refinance market is even more complex. While purchase rates are hovering around the 6% mark, refinance rates are generally higher – around 6.20% for a 30-year fixed, according to Zillow. Fortune notes an average refinance rate on a 30-year fixed at 6.33%. The question then becomes, does it even make sense to refinance?

The conventional wisdom says that a one-percentage-point drop justifies the costs. But the sources suggest that even a half-point drop "may be worth pursuing." That's a pretty wide margin of error.

Let's run some quick numbers. Refinancing a $300,000 mortgage could cost anywhere from 2% to 6% of the loan amount, putting closing costs somewhere between $6,000 and $18,000. That's a substantial upfront investment.

Consider that 82.8% of homeowners with a mortgage already have a rate below 6%, as of Q3 2024, according to Redfin. Unless you bought your house in the last year or two, refinancing at these rates likely won't save you much, if anything. The math just doesn't add up for most people.

Even the "no-closing-cost refinance" options come with a catch: a higher interest rate. It's a classic shell game. You avoid the upfront pain, but you pay more over the long term.

So, What's the Real Story?

The mortgage market is a mess. The slight dip in rates might tempt some buyers, but the volatility and conflicting data make it difficult to make informed decisions. Refinancing, in particular, seems like a risky proposition for most homeowners. The "rollercoaster" title is accurate. I wouldn't bet the house on these rates staying low for long.